- PropFirmFactory

- Posts

- ❌ TrueForexFunds Ceases Operations 🔫

❌ TrueForexFunds Ceases Operations 🔫

PLUS: FundingPips Updates

Good morning, traders! Here's your daily dose of insights from TradeDaily, keeping you ahead in the trading game.

Mr. Prop

On today’s Menu:

TrueForexFunds ceases operations ❌

FundingPips updates 😲

$GME craze is back 📈

❌ TrueForexFunds ceases operations

Moments ago, one of the industry's largest firms announced it was shutting down due to "financial insolvency."

To bring you up to date:

TFF has over 300 pending payouts

MetaQuotes removed access for TFF

2.5 years of reserves gone in 3 months

So, how did this happen?

Though nothings quite clear as of yet, we do know that 4 days ago TFF was still running promotions to generate revenue (see photo below), the CEO has been seen posting pictures riding around in a Ferrari, and the firm still committed to covering all payouts up until today’s announcement.

How does this impact the trading community?

Well… It’s not a positive event. Traders are going to experience huge blows to trust, however large community members are stepping in to mitigate damages.

Earlier Today, PropFirmMatch release statements claiming to compensate all TFF traders that have purchased challenge through PFMatch credits to a new challenge with another firm.

We acknowledge that True Forex Funds should have been delisted from Propfirmmatch earlier. Given their industry track record, reassurances to us, and transparency about the ongoing issues, we decided to initially keep them with a warning on our platform to inform users. In… x.com/i/web/status/1…

— Prop Firm Match (@PropFirmMatch)

2:53 PM • May 13, 2024

and though this event will leave a sour taste in traders mouths, its also a chance to grow together stronger and put trust in the right authorities with Financial experience.

😲 FundingPips rules update & new challenges

A whole heap of changes comes to FundingPips following continuous customer complaints and a over whelmed support team. Funding Pips was a Top 4 firm during its MT/Blackbull phase. However, their inability to scale during a massive influx of customers and payouts, along with platform and feed issues, led to their downgrade out of the top group.

We wanted to make sure to cover each and every change as they begin the climb back to the top.

1./ New Challenges

This week funding pips launched 2 new challenge, 1-step and a 3-step program. The new rules are as follows

1-step

12% T on 6% DD

$499 for $100k

daily lot size limits

Leverage -FX 1:50, Indices 1:20, Metals 1:20, Energies 1:10, and Crypto 1:2

3-step

5/5/5 T on 6% DD

$349 for $100k

daily lot size limits

leverage same as 1-step

On behalf of Funding Pips team we are thrilled to introduce the 1 step Evaluation and 3 steps Evaluation.

You asked for it, and we delivered !!

Get Your Evaluation Now!!

fundingpips.com

#fundingpips— FundingPips (@fundingpips)

7:07 PM • May 12, 2024

2./ Pricing Updates

Following the release of the new 1-step and 3-step programs funding pips also changed the prices of the 2-step program. The new prices are as detailed:

100k = $444

50k = $266

25k = $156

10k = $66

5k = $36

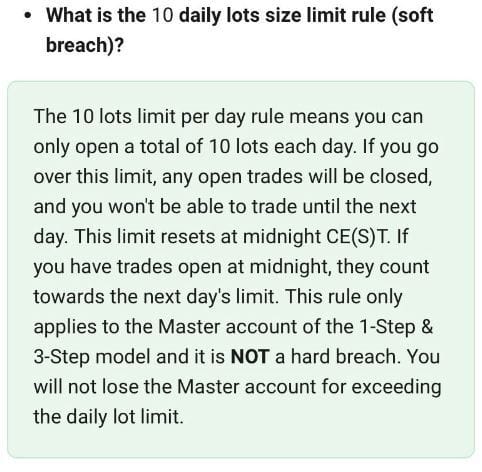

3./ Lot size limits

With the introduction of 1-step and 3-step programs FundingPips has also introduced a new “10 daily lots size limit rule”.

From the traders perspective this is only a negative, restricting daily trading activity and limiting trading strategies can only mean one thing. FundingPips is going bankrupt!

Right?… Right?

well not necessarily, from a firms perspective its all about order flow.

With two main ways of monetizing order flow either being to STP (straight through processing) orders or sell flow to a liquidity provider Khaled has took to twitter making claims the daily lot limit rule is all orchestrated to control order flow for STP.

No need for consistency rules, profits caps, payout caps.

All what is needed is controlling the flow on the 1&3 step funded stage

1- increase the traders consistency.

2- decease over trading

3- decrease reckless trading

4- decrease full margin

5- eliminate reverse… x.com/i/web/status/1…

— Khaled (@Khldfx)

5:03 AM • May 13, 2024

Though khaled has not shared any evidence of how the firm STP’s order currently we would like to believe his word, though you cant take everything people say for face value.

The CFD industry still runs off of evaluation Fees for a majority of income.

With the addition of the 1-step and 3-step programs, this could be a way for Khaled to maintain revenue while reducing risk on the 2-step challenge after raising prices.

4./ Launch of FundingTicks

Continuing on the topic of conversation.

Revenue!!

Khaled plans to launch FundingTicks a new futures trading platform with the main attraction to traders being hinted at in his recent tweet:

The end of Trailing DD era.

Good morning 🌞

Next @fundingticks ✊🏽

— Khaled (@Khldfx)

4:54 AM • May 13, 2024

unsure of how operations are being sustained for his FX firm we have no idea where he got the data to back up the claims “end of Trailing DD”

Earlier today, 5/13/2024, a popular figure and owner of the 3rd largest futures firm MYFF took to twitter spaces to explain a bit more about the operations of MyFundedFamily entities stating “Futures is far more profitable than FX.”

With matt continuing to lead into the idea that futures sustains the operations of FX its unclear where the line starts and stops with FundingTicks.

With know issues at FundingPips, new challenge updates, and the introduction of daily lot limit rules, it seems their a lot of confluence leading khaled to believe futures could be his path to sustainability.

lets us know what you think!

Is FundingTicks originated on the Idea to sustain FundingPips revenue or are all the FX changes just a coincidence?

📈 $GME craze is back

GameStop, the popular stock widely considered a meme, has halted trading 5 times in the last 24hrs due to RoaringKittys return to twitter:

Following after this tweet GameStop proceeded to rise over 50% into premarket trading with other popular influencers such as AndrewTate also joining along.

Buy 1,000,000 usd of game stop?

5,000 retweets.

— Andrew Tate (@Cobratate)

11:20 AM • May 13, 2024

This morning upon market open, short sellers officially lost $1 Billion in the first hour of trading putting the total losses this month for short sellers at $1.5 Billion.

Additionally Crypto found a way to capitalize of this news by reviving dead coins that emulate the real stock. Today Solana memecoin $GME rose over 2,900% along side $AMC up over 7,000%.

unsure of how long this meme coin craze could last we hope to see the real $GME continue to trend higher with the return of RoaringKitty.

❤️ New on YouTube

Todays new YouTube videos published by the most popular traders

1.) Massive Updates for Alpha

Alpha Capital group goes over updates in the new pubs and pints episode released May 10th. In this episode they detail thing such as adding phone support and a new course available to all traders via the dashboard.

🤣 Daily Memes

Submit memes to [email protected] for a chance to win a 100k trading account every week.