- PropFirmFactory

- Posts

- 🕵️❌Traders are Cheating Prop Firms 👀

🕵️❌Traders are Cheating Prop Firms 👀

PLUS: FundingPips is starting to restrict traders

Man the charts soldier ! This is FundingFactory, delivering you daily updates inside the trading industry.

Mr. Prop

On today’s Menu:

Fundingpips restricts profitable traders ❌

Traders are building tools to beat propfirms 🕵️

Notice to all AlphaCapital traders 👀

Ethereum ETF approved 📈

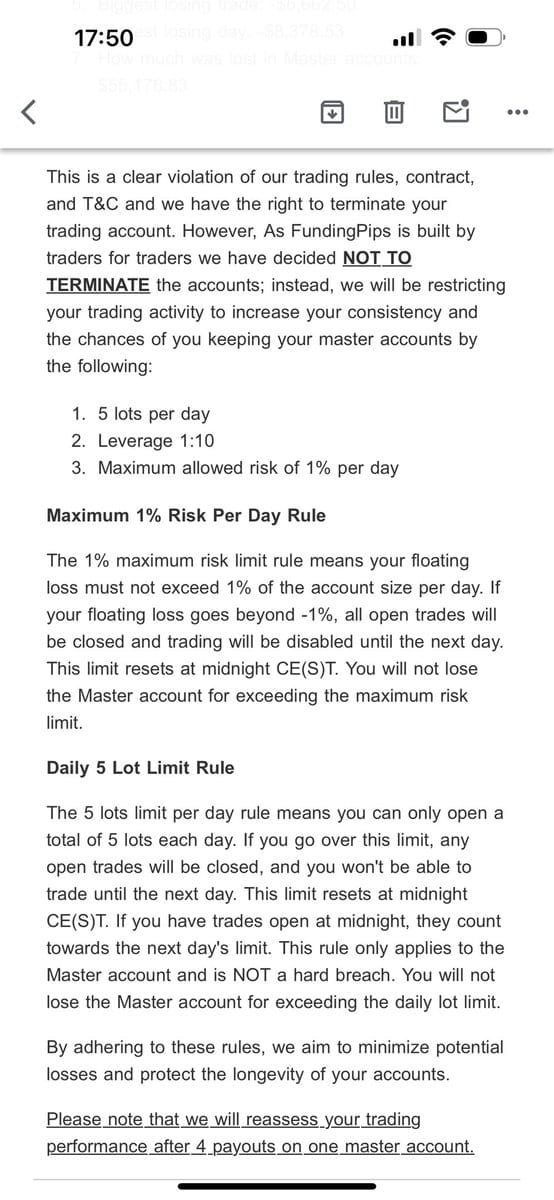

❌ Funding Pips is restricting profitable traders

Today news surfaced on twitter as a trader started making claims of restrictions being placed on his funded account.

The reason being?

The client had previously failed 20 odd challenges causing the account to be flagged for toxic trade flow.

Here’s the email the trader received:

So… as soon as the trader gets profitable or better yet, came out of a unprofitable period for their trading strategy, Funding Pips restricts the trader to the following rules as state in the email above:

5 lots per day

Leverage 1:10

Maximum Allowed risk of 1%

Now firms have done this in the past to either unwind operations or mitigate risk of ruin while waiting to relaunch or extend the companies product offering. With the launch of FundingTicks and now recently announced “FundingBroker” it’s seemingly more clear the firm is definitely not “By traders for traders”.

🕵️Traders are Cheating PropFirms

A new copy trading strategy to mask/hide the same trades being placed on multiple accounts is starting to surface inside the prop industry.

What are your thoughts on some traders Traders requesting to develop tools to cheat prop firm rules?

— Martin N. | City Traders Imperium CEO (@MartinN_CEO)

5:36 PM • May 23, 2024

Here’s the premise of how it works:

customized delay entry for each slave account

adding optional Sl and TP customizable for each slave

With the delay and pip variation its helps to avoid being flagged by prop firm risk management teams and can act as a mentor on livestream taking trades in-front of a community that is trading alongside the mentor.

How’s this helping cheaters?

By abusing the very fact that most propfirms allow trade copiers, this custom solution allows traders to trade more than one account and manage accounts for other traders. This goes directly against every single firms terms and conditions where by each firm states that the trader who KYC’d must be the trader trading the account and most firms will not allow more than one account trading the same strategy for risk of ruin.

What do you guys think?

This is obviously unethical, but should it be the props responsibility to protect against these bad actors or should the community help clean up bad actors to protect the very thing we all love, funding firms?

👀 Attention all AlphaCapital Traders

Rumors are circulating around the prop industry about Alpha Capital and this time prop traders are blaming news rules for profit restrictions.

Today TraderWixard, warned AlphaCapital traders of the irregular news trading rule stating a few difference from traditional news rules.

Be very careful about the news rule in @AlphaCapitalUK.

Many people only follow FF calendar but in Alpha we need to follow FF and myfx calendars.

They may be different. For example today there are orange events in FF that are red events in myfx.

— Trader Wixard (@TraderWixard)

7:50 AM • May 23, 2024

These days most prop firms operating with news restriction rules such as FundingPips, FunderPro, MyFundedFX, etc. all use Forex Factory news feeds.

However, as stated by TraderWixard, Alpha Capital uses both:

Forex Factory

MyFX

The difference between these being that MyFX marks most orange folders on ForexFactory as red folders. This often leads to traders being unaware of the news rules with alpha capital, and because alpha capital does not have a built in news feed, often times traders are left with emails explaining how profits during news cant be counted.

So fare warning to all alpha capital traders, make sure your checking both news sources and not just one!

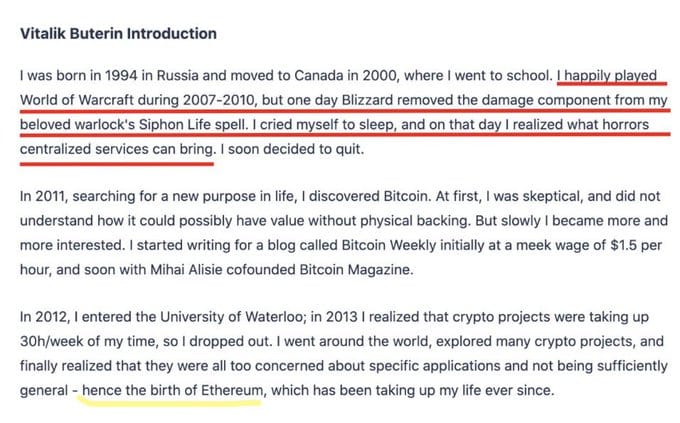

📈 Ethereum ETF’s Approved

Breaking: the SEC has approved its second ever crypto exchange-traded product, and the first ever ETF created because of a character from “world of Warcraft” had its abilities nerfed.

In its accelerated approval, the SEC focused its primary concerns to fraud and manipulation prevention.

Cited in Section 6(b)(5) of the Exchange Act, the SEC emphasized the necessity of comprehensive surveillance-sharing agreements with the CME to detect correlation between spot and futures traded markets. Even though spot ETH markets are not traded on the CME, futures contracts are. To show this correlation for ETF approval exchanges submitted correlation analysis along side the SEC internal analysis leading to confirmed results with direct correlation stating little to no market manipulation in the last 2.5 years.

How cool is it that even after the SEC attempt to qualify an “ecosystem” with smart-contracts or undertaking as securities, the very same SEC has effectively said ETH sales can’t be securities.

Its really gone full circle.

And now the very same government essentially built a synthetic asset, handled off-chain, adding to the “ecosystem” once considered a security and making the SEC more similar to the very things crypto was built to go against.

🤣 Daily Memes

Submit memes to [email protected] for a chance to win a 100k trading account every week.