- PropFirmFactory

- Posts

- Rocket21 partners with Eightcap

Rocket21 partners with Eightcap

PLUS: FPFX sues additional clients

Man your Trading Stations! This is FundingFactory, bringing all the best industry insights to one place.

Mr. Prop

On today’s Menu:

Rocket21 Re-launch 🚀

MatchTrader revokes license 🛑

Additional News on FPFX lawsuits 🔥

🚀 Rocket21 Re-launches with 8cap

After last weeks marketing stunt (as many suspected) comes to full reveal, FXAlexG announces the relaunch of Rocket21 with Eightcap.

Along-side Eightcap Rocket21 has also announced the reedition of MT4 and MT5. Which brings to question:

Does Eightcap now own Rocket21?

well… industry titans such as Mattleech are leading to believe so…

Rocket21 has emerged after the crash landing on the moon

This time, a whitelabel of eightcaps prop firm program.

The way they are able to offer MT4 and MT5 under eightcap is if eightcap owns and administers the challenges rocket21 markets.

Is this a good or bad thing that… x.com/i/web/status/1…

— Matt (@MattLeech)

7:12 PM • May 20, 2024

and after the whole MT4/5 license issue and MetaTrader working to remove grey-labels from main label licensee owners, surely Eightcap cant be confident to reintroduce new firms without revised ownership structure.

As a trader, be weary until further information is confirmed, trade with those you trust and know have main-label licenses (FTMO and 5%ers) and lets see if the famous FXAlexG marketing stunt plays in favor of his firm.

🛑MatchTrader Revokes SurgeTrader License

SurgeTrader has announced the suspension and revocation of the main operating license for SurgeTrader, LLC stating:

up to date on all fees owed to Match-trader

no violation or breach of contract

suspension of all new sales until further resolution

third-party has influenced the decisions

Match Trader drop SurgeTrader

MatchTrader's side of this situation would be fascinating to know.

— FundTraders (@FundTraders)

1:34 AM • May 19, 2024

Before Match-Trade, SurgeTrader worked with FPFXtech to facilitate challenge sales with EightCap. During this time the co-owner of surgetrader divorced spouse was charged with operating a $35 Million Ponzi Scheme where by SurgeTrader’s name was brought into legal documents.

could it be Match-trader has received insider information from FPFXtech to withdraw services? Is SurgeTrader in trouble?

Probably not.

It would be quite silly of SurgeTrader to pursue public legal action against match-trader without having good standing against the revocation. Surge Trader apologizes to all traders, stands commited to findigna respected trading platform partner, and resolving all issues with current clients.

🔥 FPFX lawsuits are heating up

FPFXTech better akin to ForestPark has added to the list of firms pursuant to legal actions by suing TheForexFunder, AqreFX, and fpfdotcom bring the total list to 6 firms:

TheForexFunder

AqreFX

Fpfdotcom

Funded Engineer

5rfcom

TopOneTrader

Out of all 6 firms, each have out thing in common; “breach of contract” and “commission not paid” equaling to 25% of sales (not revenue).

However, TJFX98 owner of TheForexFunder decided to make public statements, stating some of the claims against TFF are unjust.

TJFX98 states:

paid excess of $160,000 to FPFXtech

forced switch to IB with DXTrade

lied about risk management operations

blackmailed to spend $50,000 for migration

With all of these claims its unclear as to who is in the wrong but with the help of context clues we might be able to learn a bit more.

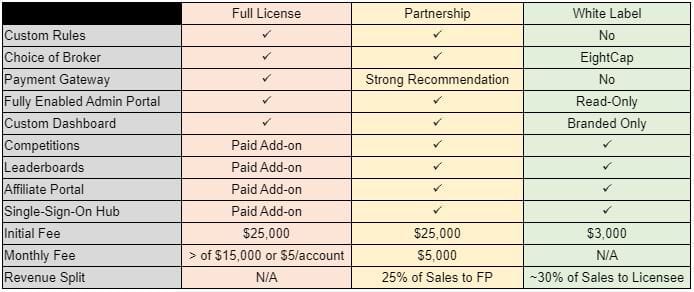

Knowingly FPFXtech has three models: Full License, Partnership, Whitelabel

Considering all sued firms have one thing in common “25% of sales to ForestPark” its safe to say TheForexFunder was a Partnership with FPFXtech and not a full license.

Included in the Partnership program:

Choice of Broker

Custom Rules

Full technology access

No mention of Risk management

minimum payment required of 5,000 or the greater of 25% sales

This means TheForexFunder likely has no legal case to build off of unjust promises for risk management but will instead build a case around the alleged blackmail to move TFF to ForestPark DXTrade IB servers.

From the looks of it, these FPFX cases come down to over ambitious founders not understanding cost of capital or technology services.

Looking at the three models fpfx sells clients on, its clear that having a full license of the technology has a higher starting cost and causes firm owners to choose partnerships.

The partnership model prays on marketing and the full license prays on those not smart enough to build the technology.

In TheForexFunders case They paid an excess of $160,000 (weather that includes the $50,000 to migrate or not) meaning they sold over $640,000 in challenges.

By spending $25k upfront to build your own crm/admin portal and connecting with brokers on an IB level to sell accounts you immediately get back 25% of sales and/or are no longer beholden to $15k monthly cost of the full license in the initial growth stage of the business.

Hopefully new firms can learn from those who come before them by reaching out and asking for advice from veterans and we wish all firms tied up in the FPFX debacle the best of luck!

💀 Say Goodbye SilverArrowFunding

Another closure for the books.

This weekend SilverArrowFunding, a smaller firm, closed doors to all new traders with no foresight to how US regulations will impact the foreseeable future:

Existing traders please go to the website to log into your funded account dashboard to continue managing your accounts.

— Silver Arrow Funding (@SilverA_Funding)

5:20 PM • May 9, 2024

With the closure announcement, SilverArrowFunding is committed to maintain payouts to all active accounts, and has since redirected their website to icmarkets.com to provide a better trading experience for any potential future customers.

We appreciate and respect and professionality of the closure and hope to see more firms offer commitments to traders by closing operations before liabilities out weigh assets.

🤣 Daily Memes

Submit memes to [email protected] for a chance to win a 100k trading account every week.