- PropFirmFactory

- Posts

- ❌Questionable practices and Future teases 😝

❌Questionable practices and Future teases 😝

PLUS: how prop firms prevent bots

Another Day, Another Dollar! Prop firm factory, delivering you daily updates inside the trading industry.

From, Mr. Prop

On today’s Menu:

Blue guardian questionable practices ✋

E8 futures tease 😝

Behind the scenes of funderpro ✨

✋ Blue Guardian Pauses New Purchases

This morning traders are taking to Twitter(X) questioning weather BlueGuardian has a main label cTrader license after the continuation of ongoing issues leaves Blueguardian pausing all purchases for the cTrader platform.

@BlueGuardiancom They do not. They use purple trading prop.

— James Glyde (@Jamesglyde)

11:22 AM • May 9, 2024

After further inspection and multiple other confirmations for those on twitter, we discovered Blueguardian is a whitelabel of PurpleTradings Ctrader license as previously setup with MT5 before the removal.

Unsure of weather Blueguardians whitelabel will impact the status of account purchases for cTrader, we awaited an announcement

low and behold,

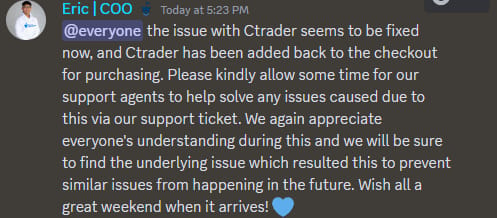

Later that day Eric, the COO of Blueguardian, announced they have brought back cTrader stating “all issues seem to be fixed” and have also directed traders to support for any persisting issues.

However, without blue guardian owning a main label license traders are still unsure of weather cTrader will be a viable option for the future.

For now BlueGuardian will still offer MatchTrader and DXtrade as alternative options with Tradelocker also coming soon.

😝 E8funding teases futures traders

Rumors are stirring inside the prop industry faster than a school yard!

After Today’s announcement by E8Markets on twitter, speculation is stirring due to #FutureofFinance and the potential for E8Futures:

FUTURE doing heavy lifting in E8 tease.

E8 futures announcement and format will be a fascinating one

E8 has always operated with higher margins thru either LP features and/or pricing.

Futures evaluation space main players are currently trusted and pay out at near 100% rate… twitter.com/i/web/status/1…

— FundTraders (@FundTraders)

2:28 PM • May 9, 2024

However, we could also see E8 roll out a new futures model similar to the MFFX one-step max program talked about earlier this week during “New Challenge Types and New lawsuits”.

✨ Behind the Curtain: FunderPro

A new article released by FinanceMagnates covering FunderPro reads more like an ad for Business interested in the technology rather than any insights to the backend of the firm.

The article touches on topics such as:

free trials

affiliate management

regulatory compliance

refund oversight

Although the article mentions the ability for clients of their backend technology to restrict users at checkout by country

it remains unclear as to how regulatory compliance is taking place when claiming to sell “A-book” funds through an unregulated entity.

We wish FinanceMagnates mentioned the SigmaWorld Forex cross over event where funderpro and Tradelocker both discussed regulations inside the industry and made leaps to determine weather evaluation entities should be considered casinos.

Besides the banter,

the rest of the Finance Magnates article went over a few new changes tot he admin dashboard for clients of FunderPro technology, and we hope to see more firms use/switch to FunderPro technology.

📈 Prop firms vs Bots

Another tweet from Lukas Stibor details the fact that new traders are often turned away from trading after trying bots

often being promised a quick profit but ultimately demoralize a traders long-term success.

Prop firms vs. Bots: New traders often turn to bots for easy profits, not realizing the hard work needed for long-term success. It's disappointing and spoils the trading experience for those genuinely committed to mastering the market.

— Lukas Stibor (@lukasstibor)

9:05 AM • May 9, 2024

When it comes to purchasing challenges with firms, we always want our traders to have long-term success,

so we at PropFirmFactory took it into our hands to do a bit more research on tools being used behind the scenes to find and deny cheaters/bots accounts and payouts:

1.) Risk Force

Risk Force is a purpose built tool to prevent bad actors (chargeback abusers, Sim ‘gamers’ etc) from ever entering a prop firms program.

When we reached out for request they were happy to tell us its a shared databased with some of the biggest contributing firms being Topstep, tradeday, and the 5%ers.

2.) Data Prizm Tech

data Prizm tech offers technology soloution for Brokers, Prop-Firms and Trading Developers. Specialing in robust anti-cheat solutions designed to detect and and prevent and form of trading malpractice (Reverse trading, Copying, HFT, etc) they ensure a fair playing field in the forex market.

and your probably asking yourself, “why should I care”?

next time your purchase a prop firm challenge to trade, take into consideration that some of the biggest firms in the industry are using these companies with shared data agreements and once you purchase a challenge with a prop firm you are to abide by the firms terms and conditions, not your own.

❤️ New on YouTube

Todays new YouTube videos published by the most popular traders

1.) Owen Morton: Making $100’s of Millions From the Trading Industry

In this episode of the Words of Rizdom Podcast we are joined by Owen Morton. The founder of TradeLocker, the innovative new platform; TradeLocker is the most innovative trading platform that stands out by listening to what traders want and actually delivering what’s promised. TradeLocker has been built by listening to what over 2.5 million traders want and need through over 10 years of experience in the forex industry. We speak to Owen about how he got into his position that he is in today. How he came across the trading industry and how between himself and his team he has provided so much value to the trading industry. Between his group he has amassed a net worth of $1 Billion Net Worth.

🍔 Post-Market Protein

Todays new YouTube videos published by the most popular traders

1./ T4B and SALVUS partner for broker launch. this joint venture is teaming up to provide a suite of services.

2/ GameStop shares surge to highest close since December. shares of popular meme stock rose more than 13% on Thursday.

3./ He spent $100,000 on challenges! A trader spent six figures on challenges with bespoke funding.

🤣 Daily Memes

Submit memes to [email protected] for a chance to win a 100k trading account every week.