- PropFirmFactory

- Posts

- ❤️ cTrader 5.0 Huge Updates 👀

❤️ cTrader 5.0 Huge Updates 👀

PLUS: breakoutprop new challenge

Hello Traders! Get informed with PropFirmFactory’s daily dose of trading industry updates!

Mr. Prop

On today’s Menu:

cTrader 5.0 release ❤️

ETF new Policy Changes 👀

BreakoutProp New Challenge 🤔

❤️ cTrader puts heat on competitors

Former cTrader executive and CEO of PipFarm, James Glyde, announced cTrader 5.0 update was released yesterday and could be a major turning point for the platform.

The cTrader 5.0 update was released yesterday. It has some game-changing features and one filling a big gap between TradingView and Ninja Trader.

- Automated trading strategies can be hosted and run in the cloud. No need for a VPS. No extra cost to use this feature.

-… x.com/i/web/status/1…— James Glyde (@Jamesglyde)

7:44 AM • May 17, 2024

With features such as:

start cbots in the cloud (no more vps)

24/7 cTrader cloud

Export algos as files

start/stop and modify bots from anywhere

overlay indicators on indicators

With all these features jam packed inside the new 5.0 update it certainly puts pressure on competitors such as MT5.

In theory, no longer should the broker or trader have to partner/purchase a VPS for cloud trading services leading to increased user activity to create bots alongside all the additional updates.

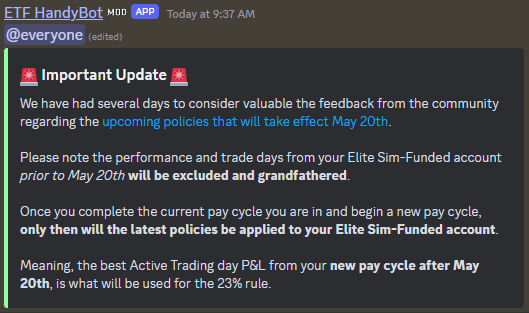

👀 ETF updates trading policy

Popular Futures Firm, EliteTraderFunding, has announced a new policy change to take effect may 20th.

Now added as an additional stipulation along side the current payout structure, traders are now required to follow 2 more rules:

A minimum of two-hundred ($200) dollars in realized profit is required

Realized profits on any given day must equal at least 23% of the best active trading day P&L

For Example: your best trading day by PnL is one thousand ($1,000) dollars making your 23% rule equal to two hundred and thirty ($230) dollars. Now any day you make profit equal to or greater than two hundred and thirty ($230) dollars it will count towards the 5 total trading days.

If you would like to read more about the policy changes please visit the recent Transparency article posted by the team!

🤔 BreakoutProp new challenge

While other propfirms are posting insolvency tweets, breakout is cooking up new evaluations. On May 16th, Breakout announced the launch of a new 1-step evaluation.

We’re launching a 1-step Breakout Evaluation.

Static drawdown.

Payouts 1 day after getting funded & every 7 days after.

No hidden rules, profit caps, or trading restrictions.

Code ‘ONESTEP’ for 10% off.

— Breakout (@breakoutprop)

2:02 PM • May 15, 2024

Included in the new evaluation:

static drawdown

first payout instant, every payout after goes on 7 day cycle

10% profit Target

4% Daily DD

6% Max DD

For those of you unfamiliar with breakout, they are a crypto focused prop firm owned by Tradermayne and CryptoCred.

Breakout tends to sell challenges above industry average prices because they offer an above industry average service with custom data feeds from ByBit (T1 Crypto Exchange) and boast an impressive in-house trading platform provided by DXTrade.

As one-step pass rates are a bit lower than 2-step pass rates and Breakout sells challenges for above average prices we often see marketing incentives such as “first payout instant” get thrown around to entice traders into purchases.

Could this be to help breakout stabilize operations? Or does static Drawdown prove the legitimacy of the offer and validate higher prices?

🎰 ICT thinks propfirms are casinos!

Today ICT released a message for prop traders stating the very method of his teachings (demo accounts) are also the same medium used by firms to operate “much like a casino”.

Message from ICT for Prop Traders.

— TheTrustedProp (@TheTrustedProp)

5:20 AM • May 17, 2024

Its important to note that ICT is encouraging traders to tread with caution but also acknowledges the fact that indeed traders can find an edge to trading with propfirms the very same way “card counters beat casinos.”

Which brings to question:

Are traders successful because of the trading strategy or is it because of the strategy used to pass?

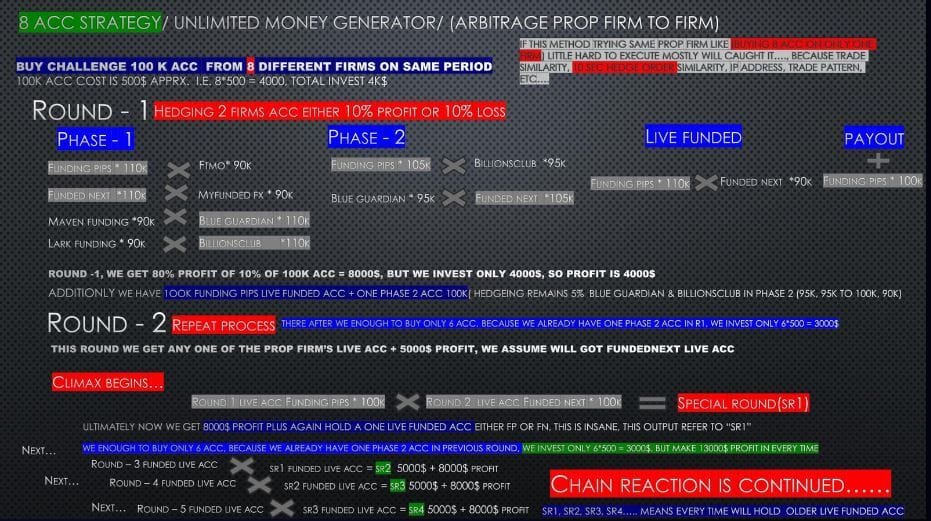

now some of you may be confused but lets break it down. Its called the 8 ACC STRATEGY.

Detailed in the photo above, is a lucrative arbitrage opportunity presented between firms.

The trader must find Firms that are not sharing data together (easiest to chose firms with different service providers/ in-house tech) and purchase 8 accounts of the same size and hedge trades between accounts to pass and get funded.

If the trader does this proficiently they create a chain reaction that snowballs into larger amount of funded accounts creating greater opportunity for payout.

In theory when traders use this type of strategy to pass challenges they no longer rely on trading and instead are playing the game similar to how “card counters beat casinos” as mentioned by ICT.

So if prop firms are gonna play traders by creating harder rules, why dont traders get a chance to try and play propfirms?

🎉 New PFMatch listing appears

Very rarely do we see a new company get listed by PropFirmMatch. Well that changes as today FinotiveFunding is welcomed with open arms.

After the partnered promotion to giveaway 5,000 accounts to traders impacted by TFF it was pretty clear the listing was going to be announced soon.

Finotive Funding is now listed on Propfirmmatch. With 3 years of operation, Finotive is one of the longest-standing prop firms. Due to our constantly increasing requirements, it is only the second of our listed firms included in 2024, out of more than 100 requests. Read more… x.com/i/web/status/1…

— Prop Firm Match (@PropFirmMatch)

9:22 PM • May 16, 2024

PropFirmMatch has had over 100 requests for lisiting sicne the start of 2024 and with FinotiveFunding beingthe second frim listed all year we wanted to highlight some key points about the firm:

in business for 3+ years

owned by Finotive group (owners of Finotive Markets and Finotive Capital)

COO Ben Hardman Ex-City of London Quant

With what seems to be a business boasted to expand in multiple verticles being lead by Ex-city of london quant trader. For PropFirmMatch, Finotive was a well thought out listing to boast the authority of ACTUAL transparency for the industry review space!

🤣 Daily Memes

Submit memes to [email protected] for a chance to win a 100k trading account every week.